You can also be interested in these:

- Why do you need cybersecurity for your router?

- Which VPN is the best for android phones in 2022?

- IT concerns about Chrome extension security issues

- What is Zero Trust Security?

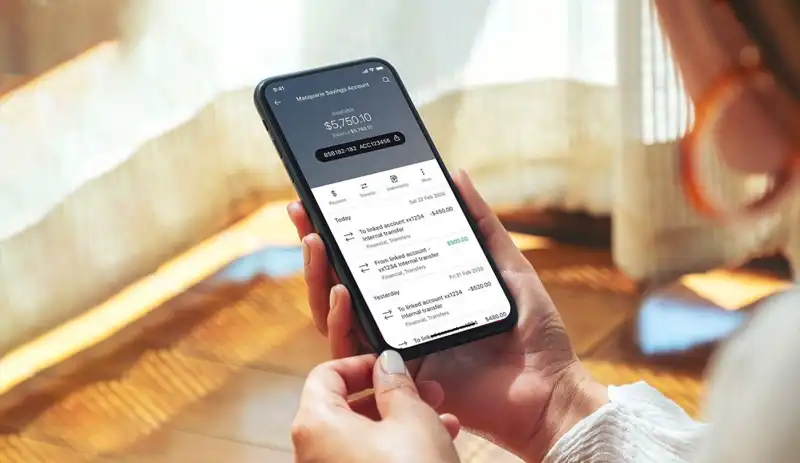

About 76% of Americans use mobile banking, which is known for its convenience and speed. Errands like keeping track of your accounts, making transfers and depositing checks can all be done straight from your phone.

Although mobile banking offers next-level convenience, various security risks are associated with it. Here’s how you can keep your information safe from phishers and hackers.

Download your banking app from a verified source

If you want to use your bank’s mobile app, make sure you find and download it from a trustworthy source. Many banks will feature it prominently on their website or have signage advertising it inside their physical location.

If you download the app from the Google Play store or the Apple App store, ensure the one you download is legitimate. You can look at the reviews and developer details, and if you still have questions, definitely confirm with your bank.

You might also want to use other banking apps for budgeting or investing. In that case, you should also ensure the one you’re downloading is trustworthy. Past data breaches will be reported, so you can find any potential issues an app might have had in the past.

Create a strong password and update it frequently

Hackers might be more likely to access your banking information if you use a weak password to log into your mobile app. Follow these password best practices:

- Make your password eight characters or longer.

- Don’t use personal information, such as your street name or date of birth.

- Make your password distinct from the other ones you use.

- Use a mix of uppercase and lowercase letters.

- Include numbers and special characters like question marks.

- Update your passwords regularly.

Enable multi-factor authentication

Multi-factor authentication can protect your online banking information by adding a second layer of security. With two- or multifactor authentication, you must take multiple steps to verify your account and log in.

An example of multi-factor authentication is entering your password or PIN as well as a four-digit code that gets sent to your mobile device via text or email. Multi-factor authentication boosts security but is not foolproof. Someone who gains access to your cellphone could bypass the prompts to access your account.

Avoid public Wi-Fi

Public Wi-Fi networks leave something to be desired in terms of safety and security. Hackers can “eavesdrop” on your sensitive information or install malware or spyware on your device. If you want to use public Wi-Fi while working at a coffee shop or out and about, disconnect from it before logging onto your mobile banking account.

Be wary of phishing scams

Phishing scams are getting trickier, and it can be shockingly easy to fall for them. They trick users into sharing sensitive or private information, which hackers can use against them. One example of a phishing scam is a fake email from someone pretending to be your bank asking you to confirm your account information.

Protect yourself and your private information from phishing scams by never following banking links sent to you over email or text. They could lead to fraudulent sites looking to steal your information. Phishers also might ask for your passwords over email — do not ever share them.

Set up security alerts

Many banks send security alerts via text or email when your account may have been compromised. Notifications about transactions or new logins can help keep your information and your money safe. These alerts let you respond to fraudulent activity quickly and efficiently if something were to happen to your account.

Security with mobile banking

Mobile banking comes with some security risks. Keep these tips and tricks in mind when downloading an app. You can enjoy the ability to handle your money without waiting in line at the bank while keeping your private information safe and secure.

More stories like this

- Why do you need cybersecurity for your router?

- Which VPN is the best for android phones in 2022?

- IT concerns about Chrome extension security issues

- What is Zero Trust Security?

- A guide to eCommerce App development in 2022

- What is softonic.com? Is it safe? Is it legit in 2022?